What can we expect in 2022 | Investments, Growth, (Wars) and Inflation?

March 2022

Continuous disruption caused by a pandemic

2022 Economic Outlook show us today clear what we can expect in April 2022 – 2023.

The global growth is expected to slow a lot in 2022, from 5.50% down to 4.10%, according to current indicators in the industrial and global markets.

This reflects the continuing disruption caused by the Pandemic, as well as supply bottlenecks that are becoming an increasing problem.

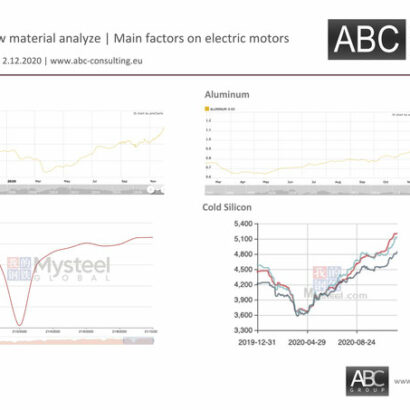

The recovery in global activity, along with supply disruptions and higher food and energy prices, have spurred major inflation in many countries.

The slowdown in 2022 reflecting the continuing expansion of the Pandemic, reduced fiscal support and long-standing supply bottlenecks. At the same time, the Ukrainian crisis & war in Europe is hampering the work of world and mostly European industry.

Although production and investment in advanced economies is projected to return to pre-pandemic trends next year, they will remain significantly lower in emerging and emerging markets (EMDE) due to the Pandemic, tighter fiscal and monetary policy and more permanent scarring than pandemics.

World is now looking at a variety of negative risks that are blurring the outlook, including concomitant economic disruptions fueled by the new virus variants, further supply bottlenecks, reduced inflation expectations, financial stress, climate disasters and weakening long-term growth drivers.

Let’s look at the main changes in the world market

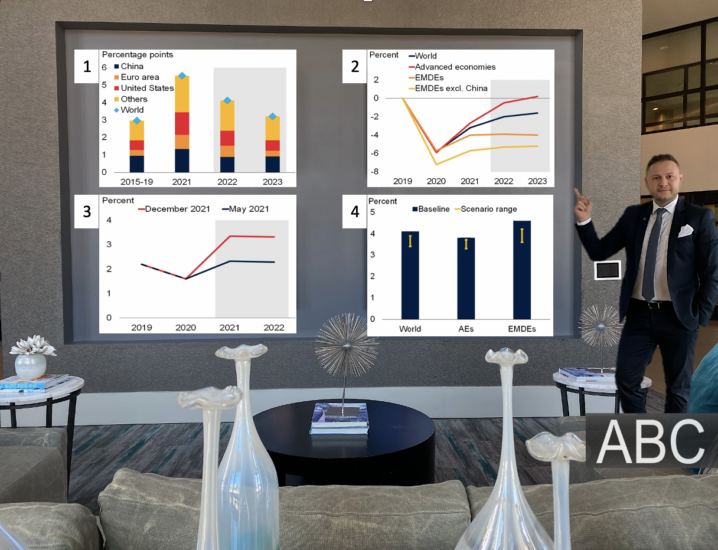

1. Global growth is projected to decelerate in 2022 and 2023

Global growth is set to slow sharply, as the initial rebound in consumption and investment fades and macroeconomic support is withdrawn. Much of the global slowdown over the forecast horizon is accounted for by major economies, which will also weigh on demand in emerging market and developing economies (EMDEs).

2. EMDEs are projected to experience a weaker recovery than advanced economies

In contrast to advanced economies, most EMDEs are expected to suffer substantial scarring to output from the pandemic, with growth trajectories not strong enough to return investment or output to pre-pandemic trends over the forecast horizon of 2022 – 2023.

3. The global inflation is expected to remain elevated in 2022

The rebound in global activity, together with supply disruptions and higher food and energy prices, have pushed up headline inflation across many countries. More than half of inflation-targeting EMDEs experienced above-target inflation in 2021, prompting central banks to increase policy rates. Consensus forecasts anticipate median global inflation to remain elevated in 2022.

4. Significant economic disruptions caused by the rapid and simultaneous spread of a new variant of the virus are a key negative risk for short-term growth

The slowdown in global growth in 2022 could be sharper if the spread of new variants continues and encourages the reintroduction of strict pandemic control measures in large economies. Economic disruptions could further reduce global growth this year – from 0.2 to 0.7 percentage points, depending on today’s assumptions. Related dislocations could also exacerbate supply bottlenecks and exacerbate inflationary pressures.

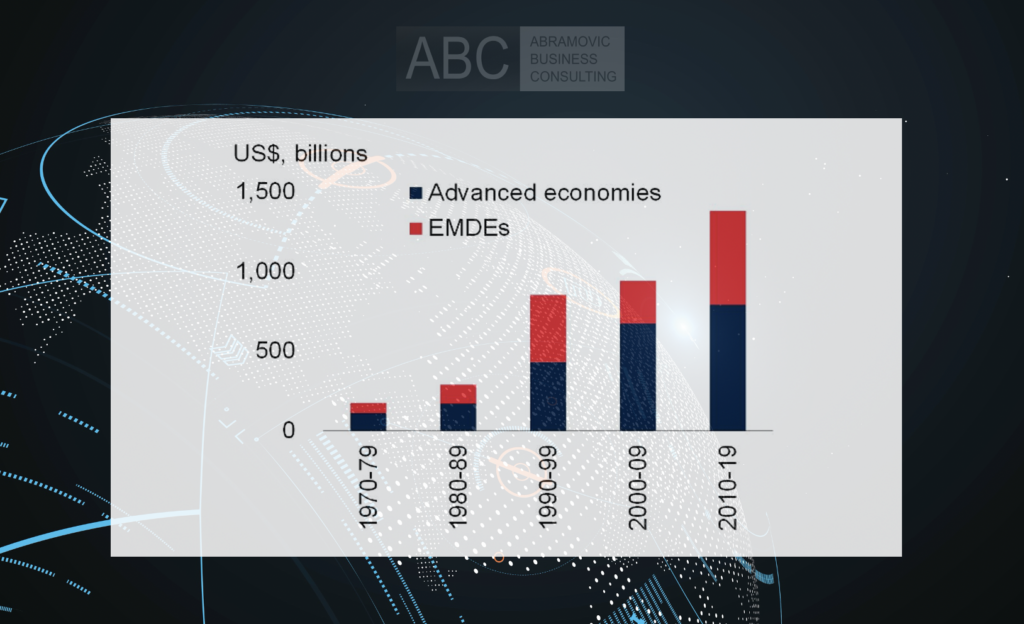

*In this table we can see Economic losses from weather and climate disasters

We can also mention: in 2020, 2021 and until now in 2022 we are recording significant climate change. Means that the global cooperation and effective national policies will be needed to address the severe costs associated with next weather and climate disasters.

- Very serious natural disasters (Germany, Belgium, Philippines, Turkey, Czech Republic, Italy, Indonesia, India, Nepal, Haiti, Guatemala, US, Mexico etc.) and climate-related events could also disrupt the recovery in EMDEs.

- We need to ask us if the international community can also help by increasing adaptation to climate change, increasing green investment and facilitating the transition to green energy in many EMDEs, and is this the right path to take now?!

- The National policy activities can also be adapted to promote investment in renewable energy and infrastructure and to encourage technological development, but this needs to be worked on directly with society.

- In addition, policy makers can prioritize real reforms that boost growth and increase preparedness for future climate crises.